Since its first release in 2007, the iPhone has revolutionized the smartphone industry and become an iconic product for Apple. But what if instead of upgrading to each new iPhone model over the years, you had invested that money in Apple stock instead? As it turns out, you could have made over $100,000 by now.

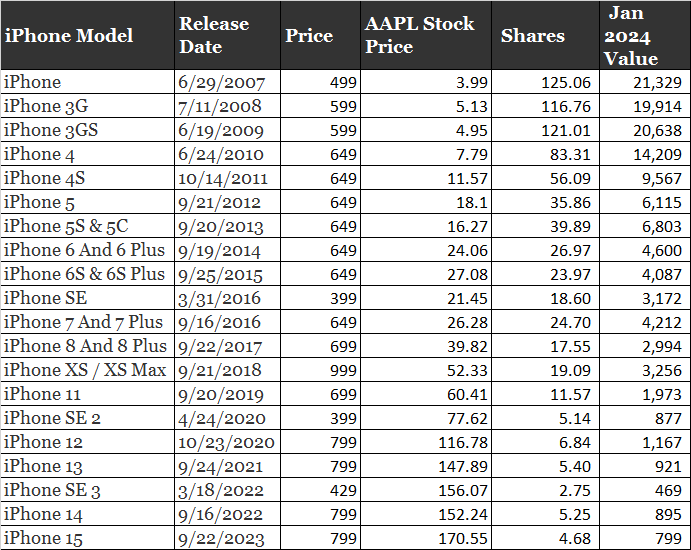

An analysis of iPhone launch prices compared to AAPL stock prices reveals just how lucrative investing in Apple could have been. If you had purchased $499 worth of AAPL shares instead of buying the first iPhone in 2007, that investment would be worth over $21,000 today. And if you continued investing the cost of each new iPhone into Apple stock, that total of $13,060 would now be a portfolio valued at $128,157.

At first glance, this comparison may seem unfair – after all, an iPhone delivers practical everyday utility, while a stock portfolio just sits there. But this contrast reveals a thought-provoking insight into the difference between consuming and investing. It prompts the question: what returns could we have seen if we had focused more on investing our extra income rather than purchasing depreciating goods?

The over 880% return from methodically investing in AAPL illustrates the power of compound growth over time in the stock market. Of course, few could have predicted Apple’s meteoric rise back in 2007. Yet, identifying quality companies and investing for the long-term remains a proven wealth-building strategy.

Apple’s innovation and loyal customer base have undoubtedly fueled its success. While past performance is no guarantee of future results, Apple’s track record of releasing hit products points to a company poised for continued growth. For investors, Apple represents a bellwether stock and core portfolio holding.

This analysis provides a lesson in financial opportunity cost. The instant gratification of upgrades comes at the price of potentially far greater investment returns later. With some discretionary spending more mindfully directed towards investments, everyday people could build significant wealth over time.

Ultimately, upgrading to enjoy the latest technology or investing for the future remain personal choices involving individual financial situations. Yet, occasionally foregoing a new iPhone in favor of long-term AAPL positions can be a savvy decision for investors. Those willing to forego instant purchases in favor of compounding growth may just find their patience rewarded with surprising wealth.